- AlphaY Newsletter

- Posts

- 📊 AlphaY.io Development Update

📊 AlphaY.io Development Update

NEW: Cash Flow Analysis Tool

You're right! Let me add back the detail:

Week of September 26 - October 3, 2025

Hey Searchers! 👋

Got something new we're pretty excited about and would love your feedback on.

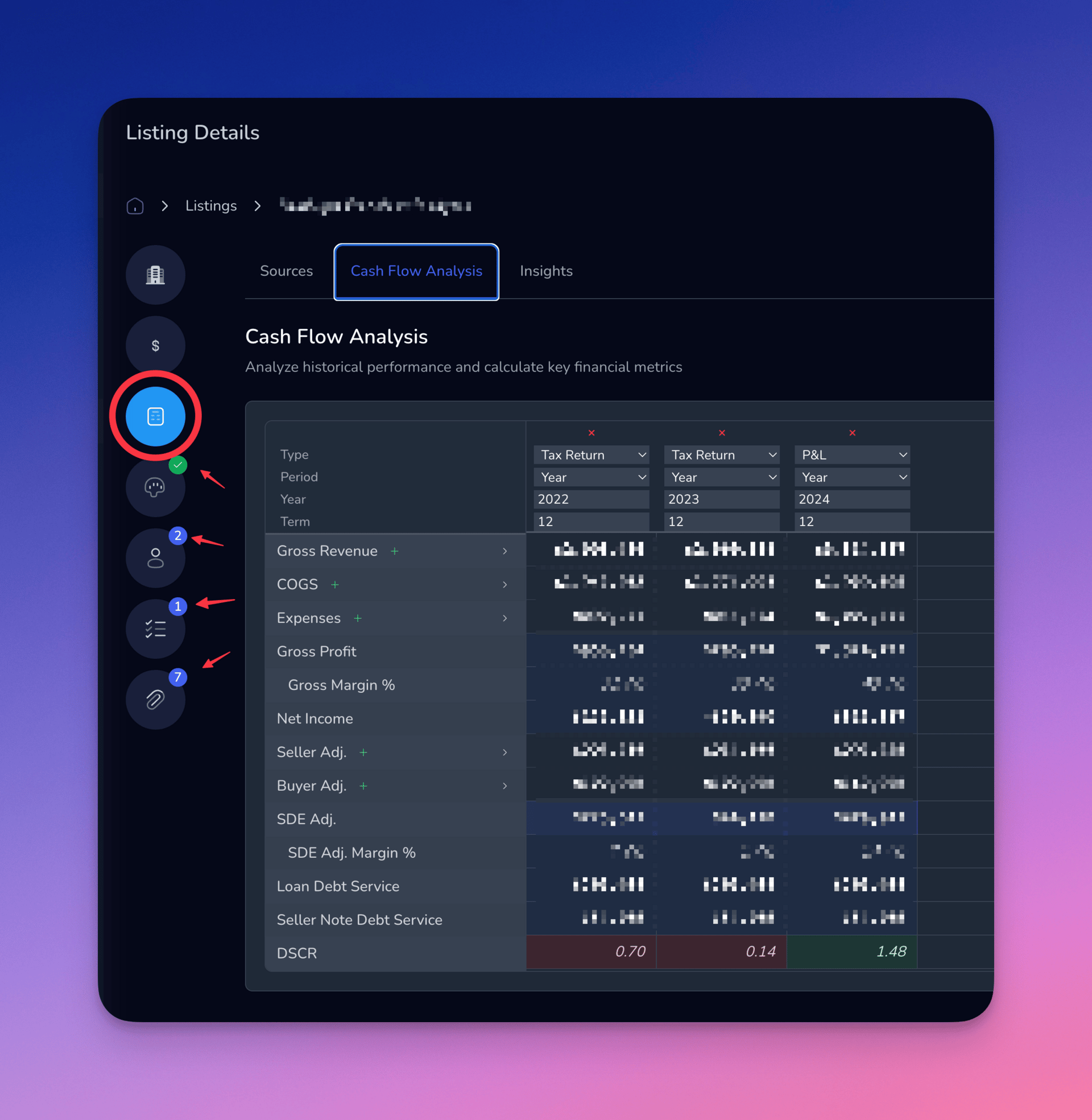

🎯 NEW: Cash Flow Analysis Tool (Beta)

We just launched our Cash Flow Analysis system - think of it as the financial modeling tool that actually speaks bank language. 💼

Why this matters:

Major banks need specific information formatted in specific ways. Our new tool gives you exactly that - multi-year financial reviews with proper DSCR calculations, trend analysis, and all the metrics banks actually look at when evaluating deals.

What you can do:

📊 Input Sources: Streamlined data entry with intelligent validation

💰 Cash Flow Review: Real-time analysis with accurate DSCR calculations

💡 Annual Insights: Instant business health assessment and trends with interactive vertical bar charts

🎯 Quick Assessment: Executive summary cards for rapid decision-making

🔍 Year-over-Year Growth Analysis: True YoY growth tracking for consecutive years with volatility indicators

💼 Debt Capacity Analysis: Banking-standard DSCR calculations with color-coded health status (Green 1.25+, Yellow 1-1.25, Red <1)

🎨 Dark Mode Support: Enhanced user experience across all components

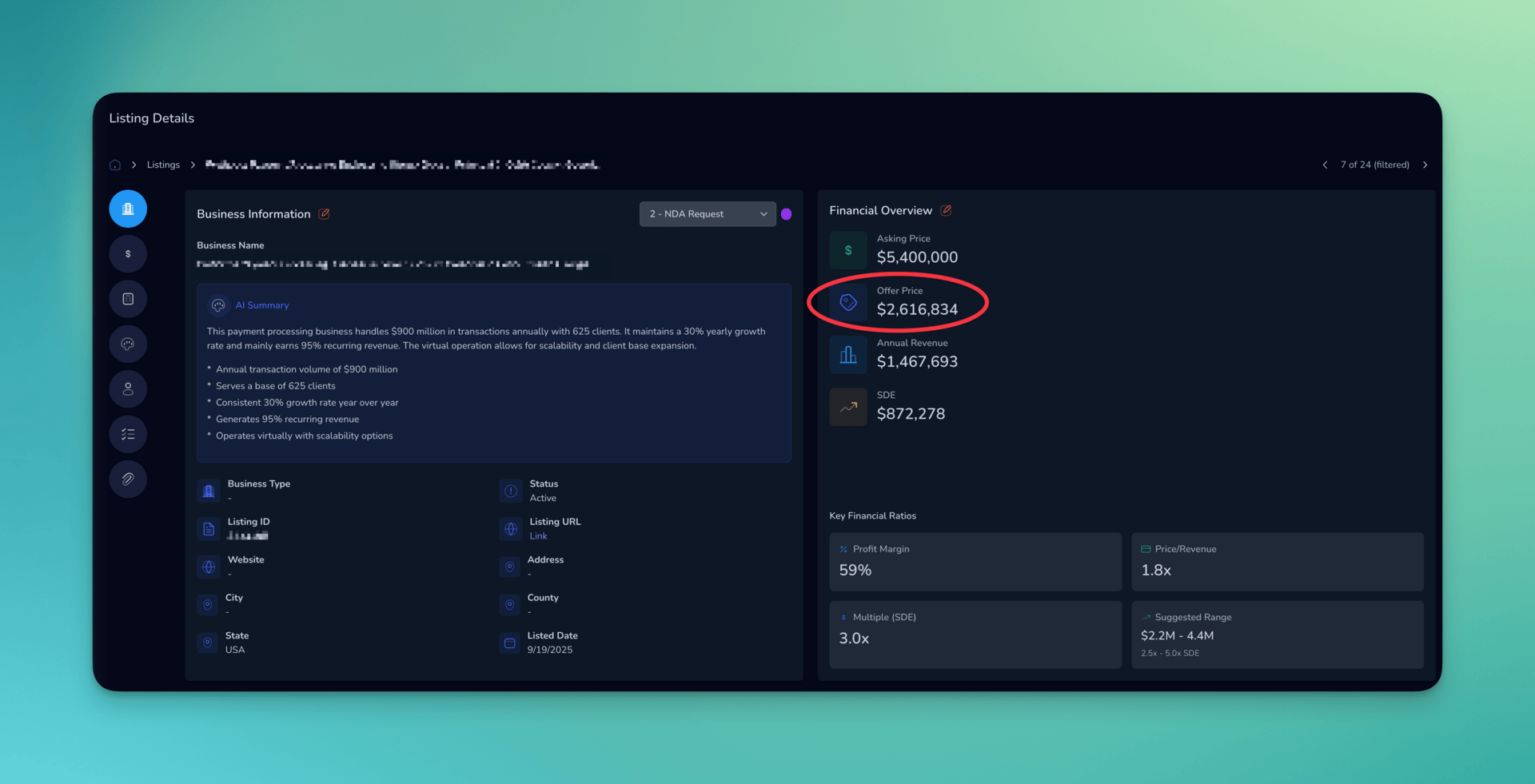

💵 NEW: Offer Price Field

Added a dedicated Offer Price field so you can keep track of the original asking price while modeling your actual offer.

Here's how it works:

Once you enter your offer price, all the financial calculations automatically recalculate using your new number - DSCR, cash-on-cash return, all of it. Makes it super easy to model different offer scenarios without losing the original listing price.

🗺️ Workflow Guide

Here's how most folks are using the platform:

1. Import listings 📥

Use bulk import or our Chrome extension to pull in deals you're tracking.

2. Quick assessment ⚡

Jump to the Financial tab for a fast look at the key metrics - SDE, revenue, asking price. This helps you figure out if it's worth diving deeper and what your initial offer price might be.

3. Add detailed financials 📊

Once you get the CIM (Confidential Information Memorandum), add either summary data or full granular detail from tax returns and P&Ls. You can do full years or partial years - whatever you've got.

4. Review year-over-year insights 🔍

Head to the Cash Flow Analysis tool to see detailed YoY business trends, DSCR calculations, and all those banking metrics we just added.

Quick note: The AI Analysis tab still previews only the last year's financials from the main listing page. The multi-year deep dive happens in Cash Flow Analysis.

🚀 Coming Soon

Projections Tool 📈

Forward-looking financial projections and scenario planning - ties right into your Cash Flow Analysis data. Launching later this month!

AI Import 🤖

Upload financial statements and let AI do the data entry heavy lifting.

🔧 Also Fixed This Week

AI Business Analysis Overhaul 🤖

Fixed checkmark validation for meaningful analysis

Enhanced data validation with reusable utilities

Improved TypeScript consistency across components

Banking-Standard Calculations 💰

DSCR formula now uses sum of Buyer Adjustment line items

Debt service calculations are year-aware for all loan types

SDE adjustment corrected (Net Income + Seller Adj. - Buyer Adj.)

Visual indicators with color-coded DSCR health status

Enhanced User Interface 🎨

Expense rows styled in pale red for visual hierarchy

Italicized percentages and financial ratios

Green/Yellow/Red DSCR color coding

Consistent styling across expense and debt service presentation

Enhanced Data Management 🗑️

Smart delete operations with confirmation dialogs

Real-time percentage and ratio updates

Intelligent cleanup with proper data synchronization across periods

📋 Migration Timeline

Now - December 2025: Transition Period

Both the old Historical Financials Modeler and new Cash Flow Analysis are available. Training materials and data migration assistance available.

January 2026: Full Migration

Historical Financials Modeler discontinued. Cash Flow Analysis becomes the primary system with Projections Tool fully integrated.

Why migrate?

✅ Superior accuracy in debt service calculations

✅ Enhanced visual insights with interactive charts

✅ Better user experience with modern UI/UX

✅ Real-time validation and error prevention

✅ Banking-compliant calculations and reporting

This is BETA - we'd love your feedback! 💬

Try it out, break it, tell us what's confusing, what's missing, or what works great. Your input helps us make this tool actually useful for your workflow.

- The AlphaY.io Team